Seems like an obvious answer, right?

I mean insurance companies are the ones you pay your premium’s too.

When you have a claim, the check comes from the company, not the agent.

The contract itself is written with the company.

So why am I even asking this question?

Because I feel the answer isn’t as obvious as you may think.

Yes, I might be a little biased but just go with it for a second.

Difference between an Insurance Agent and an Insurance Company

Let’s start by breaking down what the difference between an insurance agent and an insurance company is.

Insurance Agent

An Insurance Agent or sometimes referred to as a broker is who sells insurance policies directly to the consumer written through different insurance companies. There are two types of insurance agents, Captive Agents, and Independent Agents.

Independent Agent

Independent Agents represent many different insurance carriers and typically sell a variety of insurance products. Independent Agents, like Crowley Insurance, can choose what insurance product and company work best for each individual client. Independent agents are truly independent where they do not work for an insurance company, only have agreements to sell their products. Independent Agents work for the client.

Captive Agent

Captive Insurance Agent’s represent one insurance carrier and usually have limited options to choose from. Captive Agents are usually employed by the Insurance Carrier with specific guidelines and rules to follow. The main benefit of a captive agent is name recognition. They benefit from the marketing and advertising dollars of State Farm and Geico.

Insurance Company

An insurance company is a financial institution that provides the insurance contract, represented by a policy, to individuals or business entities. Insurance companies are who calculate what your insurance premiums are, and they do this by using their actuarial staff analyzing claim data to determine how they can remain profitable.

Insurance companies can offer a wide variety of products or they can be very niche specific on the products they can offer. Insurance companies also vary in size. They can be very small and write insurance in only one state or they can be a large National Company like Travelers, Liberty Mutual, State Farm, or Geico.

Number of Insurance Agents

The idea of getting rid of insurance agents and having insurance company’s sell policies directly has been discussed for the past 40 years.

I feel the more it gets discussed, the more the need to have an insurance agent becomes important.

Insurance policies are getting more detailed and the knowledge needed to adequately choose an insurance package for your specific needs is missing.

Insurance companies continue to allow consumers to purchase their own coverage’s online. This is causing consumers to have gaps and inadequate coverage’s protecting their assets.

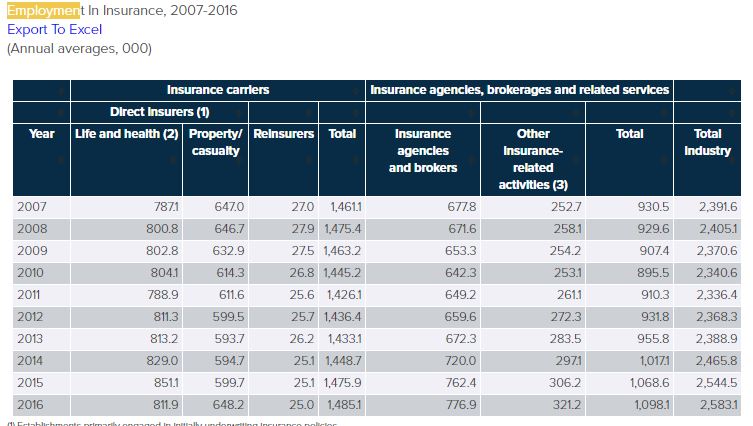

As you can see, the number of insurance agencies and brokers has grown significantly from 2007 to 2016.

We appreciate our friends at the Insurance Information Institute for the above data. Here is a link to find out more Fact’s and Statistics regarding the industry

The Truth

Now that you made it this far, here is what you have been waiting for, the answer to the question.

The most important person in the insurance process is,

THE RIGHT INSURANCE AGENT.

Who is the Right Insurance Agent?

Great Question, as you can tell from the statistics above there are many insurance agents and brokers. You already probably k now a handful of them, I mean they are on almost every street corner.

Literally, I can walk to three other agencies from my office within 5 minutes.

Here are the Characteristics to look for when trying to find the Right Insurance Agent:

Accessibility

Being accessible will mean something different to everyone and that is why I put this one first.

Your needs might include an office to stop in for some face to face communication with your agent or you might want an agent that has the technology in place to make getting your insurance set up as simple and painless as possible for you.

They will also respond to you. If you email or call them, you will get a response in a short period of time. That doesn’t mean three days either.

Education

This does not mean your agent has their masters or an entire alphabet of designations listed after their name’s in their email signature.

This means when you purchase insurance or ask a question, they explain coverage’s to you so you can understand it.

When buying an insurance policy, you aren’t expected to understand or know what the coverage’s mean. The Right insurance agent is going to explain the coverage’s you need and why you need them.

Technology

The average age of the current insurance industry employee sits around 59 years old, the agents that develop ways to better serve clients using technology are the ones that are going to be on top.

Do you know there are still insurance agencies that don’t have a website?

I know crazy right?

What’s worse, is the agencies that have a website, but use it as a static page that just has basic information on it. They knew the importance of a website 15 years ago but haven’t changed it since. And you know it isn’t optimized to be viewed on a mobile device either.

Insurance agencies that develop ways to service clients using tools like your website are the agents that you as the consumer want to find.

Service

For years, Insurance agencies would say that the one thing that separates them from their competition was the service they give.

But was it?

Really?

Agencies need to be involved in the claim process. Ones that tell you to call the insurance company’s 800 number to file the claim are not the Right agents. Agents need to not only discuss with you the claim process from the beginning, file the claim, but also make sure the process is going smoothly.

Agents are not open 24 hours a day or 7 days a week. Nor should they be expected to be. But, what are they doing for you off hours, because your insurance issues don’t always happen between 9-5 Monday through Friday.

For us, we established tools on our website that help solve this weakness that agencies have had for years. We have a place where you can start a quote and a service center that allows clients to file a claim, request ID cards or certificate’s especially during non-business hours.

Even though it is relatively new our clients have had a great experience. See what one client recently said after filing a claim on our website

Bottom Line

If Insurance Agents continue to push consumers directly to the insurance company to handle the service needs, then yes, I would agree that the answer to the initial question would be different.

But the agents that continue to provide the experience that a consumer deserves will always be the most important part of the insurance relationship.

Can you imagine a world where you didn’t have an agent and the consumer had to do everything directly with the insurance company? It will be like dealing with the cable company.

If you don’t feel that you are with the “Right” Insurance Agent. Fill out the form below and our team at Crowley Insurance would love to show you who the Right Insurance Agent is.