Commercial Liability Limits

If you are a New York business owner and have a business liability insurance policy, you may be wondering, what is the difference between the two limits you see on your insurance policy.

The liability insurance policy you carry will have two different coverage limits,

- per occurrence/claim

- or per aggregate.

What does each of these mean?

Per Occurrence Limit

The per occurrence limit is the most the insurer will pay for damages resulting from one occurrence or claim. The policy will not pay for more than this limit for any one incident.

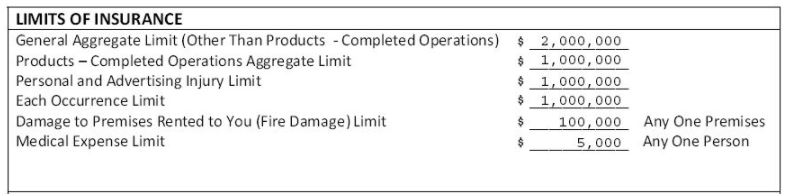

A standard general liability policy will have a $1,000,000 per occurrence coverage limit.

Per aggregate limit

The aggregate limit is the total amount the insurer will pay in any one policy term. If unfortunately, you have multiple large claims in one given year, the aggregate limit will be there to help protect you.

The aggregate limit is usually double the occurrence limit. So in the example above, if you have a $1,000,000 per occurrence limit, you most likely will have a $2,000,000 aggregate limit. Each policy is different so make sure you review in case your coverage is different. Here is another way it will look on your policy documents.

Which limit is more important

Your per occurrence limit is the most important one because that is what would be considered your coverage protection.

If someone asks for proof of insurance or how much coverage you carry as a business, they are asking for the occurrence limit.

This is the limit that is going to protect your business and business assets in the event of a claim.

The Bottom line

Each insurance policies uses different language and has different wording, which is why businesses must understand some of the terminologies they might encounter when reviewing their coverage.

Having a basic understanding of your coverage is important but just as important is having a trusted insurance agent who can help you through these conversations.

Reach out to your insurance agent to have this conversation, if you don’t have a relationship with an agent or want a review of your insurance then click the button below to schedule a review with one of our trusted insurance advisors.